LNP CDMO Market Forecast and Outlook 2025 to 2035

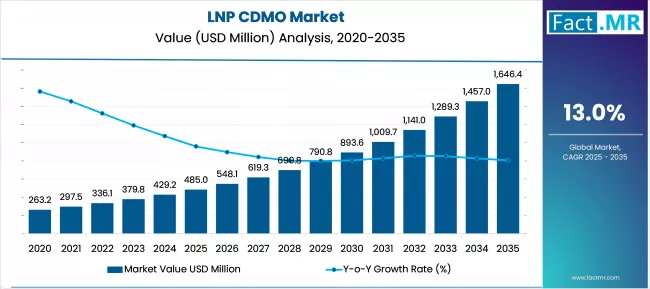

The LNP CDMO industry stands at the threshold of a decade-long expansion trajectory that promises to reshape biopharmaceutical manufacturing infrastructure and advanced drug delivery technology. The market’s journey from USD 485.0 million in 2025 to USD 1,646.4 million by 2035 represents substantial growth, the market will rise at a CAGR of 13.0% which demonstrating the accelerating adoption of lipid nanoparticle manufacturing systems and specialized biotechnology solutions across pharmaceutical, gene therapy, and mRNA vaccine sectors.

The first half of the decade (2025-2030) will witness the market climbing from USD 485.0 million to approximately USD 903.8 million, adding USD 418.8 million in value, which constitutes 45% of the total forecast growth period. This phase will be characterized by the rapid adoption of manufacturing services systems, driven by increasing mRNA vaccine development and gene therapy advancement concerns worldwide. Advanced LNP formulation capabilities and specialized production features will become standard expectations rather than premium options.

The latter half (2030-2035) will witness sustained growth from USD 903.8 million to USD 1,646.4 million, representing an addition of USD 746.2 million or 55% of the decade’s expansion. This period will be defined by mass market penetration of development services systems, integration with comprehensive biopharmaceutical manufacturing platforms, and seamless compatibility with existing pharmaceutical infrastructure. The market trajectory signals fundamental shifts in how pharmaceutical and biotechnology companies approach advanced drug delivery manufacturing, with participants positioned to benefit from sustained demand across multiple application segments.

Quick Stats for LNP CDMO Market

- LNP CDMO Market Value (2025): USD 485.0 million

- LNP CDMO Market Forecast Value (2035): USD 1,646.4 million

- LNP CDMO Market Forecast CAGR: 13.0%

- Leading Product Type in LNP CDMO Market: Manufacturing Services Type

- Key Growth Regions in LNP CDMO Market: North America, Europe, and Asia Pacific

- Top Key Player in LNP CDMO Market: Catalent Inc.

LNP CDMO Market Year-over-Year Forecast 2025 to 2035

The LNP CDMO market demonstrates distinct growth phases with varying market characteristics and competitive dynamics. Between 2025 and 2030, the market progresses through its technology adoption phase, expanding from USD 485.0 million to USD 903.8 million with steady annual increments averaging 13.0% growth. This period showcases the transition from basic CDMO services to advanced systems with enhanced LNP formulation capabilities and integrated quality management systems becoming mainstream features.

The 2025-2030 phase adds USD 418.8 million to market value, representing 45% of total decade expansion. Market maturation factors include standardization of manufacturing protocols, declining component costs for LNP production arrays, and increasing pharmaceutical awareness of advanced drug delivery benefits reaching 85-90% effectiveness in therapeutic applications. Competitive landscape evolution during this period features established manufacturers like Catalent Inc. expanding their LNP CDMO portfolios while new entrants focus on specialized formulation capabilities and enhanced production standards.

From 2030 to 2035, market dynamics shift toward advanced integration and multi-client deployment, with growth accelerating from USD 903.8 million to USD 1,646.4 million, adding USD 746.2 million or 55% of total expansion. This phase transition logic centers on development services systems, integration with pharmaceutical automation networks, and deployment across diverse biotechnology scenarios, becoming standard rather than specialized applications. The competitive environment matures with focus shifting from basic CDMO capability to comprehensive biopharmaceutical manufacturing systems and integration with quality monitoring platforms.

LNP CDMO Market Key Takeaways

At-a-Glance Metrics

| Metric | Value |

|---|---|

| $ Market Value (2025) → | USD 485.0 million |

| $ Market Forecast (2035) ↑ | USD 1,646.4 million |

| # Growth Rate ★ | 13.0% CAGR |

| Leading Technology → | Manufacturing Services Type |

| Primary Application → | Pharmaceutical Companies Segment |

The market demonstrates strong fundamentals with manufacturing services systems capturing a dominant share through advanced LNP production and specialized biotechnology deployment capabilities. Pharmaceutical company applications drive primary demand, supported by increasing facility spending on advanced drug delivery systems and therapeutic development management solutions.

Geographic expansion remains concentrated in developed markets with established pharmaceutical infrastructure, while emerging economies show accelerating adoption rates driven by biotechnology modernization and rising therapeutic innovation awareness.

Opportunity Pathways – LNP CDMO Market

The LNP CDMO market represents a compelling intersection of biopharmaceutical manufacturing, advanced drug delivery, and therapeutic innovation management. With robust growth projected from USD 485.0 million in 2025 to USD 1,646.4 million by 2035 at a 13.0% CAGR, this market is driven by increasing mRNA vaccine development, pharmaceutical infrastructure upgrades, and regulatory pressures for advanced manufacturing practices.

The market’s expansion reflects a fundamental shift in how pharmaceutical and biotechnology companies approach specialized drug delivery manufacturing infrastructure. Strong growth opportunities exist across diverse applications, from mRNA vaccine production requiring reliable formulation standards to gene therapy facilities demanding advanced LNP capabilities. Geographic expansion is particularly pronounced in developed markets, led by United States (14.8% CAGR) and Germany (14.2% CAGR), while established regions drive premium positioning and technology innovation.

The dominance of manufacturing services and pharmaceutical company applications underscores the importance of proven production technology and operational reliability in driving adoption. Manufacturing complexity and quality compliance requirements remain key challenges, creating opportunities for companies that can simplify production while maintaining therapeutic standards.

- Pathway A – Advanced LNP Formulation Technology Integration. Development of next-generation lipid nanoparticle systems with enhanced encapsulation capabilities, targeted delivery features, and improved stability can command premium pricing while meeting stringent therapeutic requirements. Integration with advanced analytics and process optimization capabilities creates competitive differentiation. Expected revenue pool: USD 250-350 million.

- Pathway B – Geographic Expansion & Market Localization. Strong growth opportunities in United States (14.8% CAGR) and Germany (14.2% CAGR) through specialized manufacturing partnerships, region-specific formulation variants, and compliance with local pharmaceutical regulations. Localization reduces costs and addresses supply chain vulnerabilities while enabling market penetration. Revenue opportunity: USD 200-280 million.

- Pathway C – Pharmaceutical Integration & Biotech Compatibility. Developing systems that seamlessly integrate with pharmaceutical development platforms, offering comprehensive LNP manufacturing, formulation analytics, and regulatory compliance optimization. Focus on compatibility with existing biotechnology infrastructure and simplified validation processes. Pool: USD 180-240 million.

- Pathway D – Gene Therapy & RNA Therapeutics Expansion. Specialized systems meeting advanced therapeutic standards for gene therapy companies, RNA therapeutic developers, and pharmaceutical R&D facilities where enhanced formulation capabilities and regulatory compliance justify premium pricing. Focus on precision manufacturing and enhanced analytical capabilities. Revenue uplift: USD 150-200 million.

- Pathway E – Sustainable Manufacturing & Environmental Certification. Systems designed for green chemistry compliance, waste reduction, and environmental sustainability that appeal to environmentally conscious pharmaceutical facilities. Integration of sustainable materials and reduced environmental footprint throughout production lifecycle. Expected upside: USD 120-160 million.

- Pathway F – Modular & Flexible Manufacturing Solutions. Simplified production systems designed for multi-product facilities, reducing complexity and changeover costs while maintaining pharmaceutical-grade quality. Focus on flexible infrastructure requirements and rapid product switching compatibility. Innovation pool: USD 100-140 million.

- Pathway G – mRNA Vaccine Manufacturing Specialization. Tailored solutions for vaccine manufacturers with high-volume capacity, cold-chain integration, and specialized quality control for pandemic response applications. Enhanced scalability and automated production control for emergency manufacturing environments. Strategic value: USD 80-120 million.

Why is the LNP CDMO Market Growing?

Advanced drug delivery demand creates compelling therapeutic advantages through LNP CDMO systems that provide enhanced bioavailability without compromising safety profiles, enabling pharmaceutical companies to develop breakthrough therapies while maintaining production efficiency and reducing development costs.

Biopharmaceutical modernization programs accelerate as pharmaceutical operators worldwide seek specialized manufacturing systems that complement traditional production processes, enabling precise formulation control solutions that align with regulatory goals and therapeutic effectiveness requirements.

Healthcare innovation enhancement drives adoption from pharmaceutical and biotechnology facilities requiring effective LNP production solutions that minimize formulation risks while maintaining therapeutic standards during complex manufacturing operations.

However, growth faces headwinds from manufacturing complexity challenges that vary across facility types regarding formulation integration and quality control requirements, potentially limiting deployment flexibility in certain production environments. Technical limitations also persist regarding scalability and production capacity that may increase operational costs in high-volume applications with demanding quality standards.

Segmental Analysis

The market segments by service type into manufacturing services, development services, and analytical services categories, representing the evolution from basic CDMO operations to comprehensive biotechnology solutions for integrated pharmaceutical manufacturing.

The application segmentation divides the market into mRNA vaccines, gene therapy, siRNA therapeutics, and other sectors, reflecting distinct requirements for therapeutic applications, formulation complexity, and regulatory compliance.

The end-user segmentation covers pharmaceutical companies, biotechnology companies, and research institutes, with pharmaceutical applications leading adoption while biotechnology companies show accelerating growth patterns driven by therapeutic innovation programs.

The segmentation structure reveals technology progression from basic manufacturing services toward integrated development platforms with enhanced LNP capabilities and automated quality monitoring features, while application diversity spans from vaccine production to gene therapy requiring specialized therapeutic manufacturing solutions.

By Service Type, the Manufacturing Services Segment Accounts for Dominant Market Share

Manufacturing services command the leading position in the LNP CDMO market through advanced production features, including comprehensive LNP formulation, scalable manufacturing capabilities, and cost-effective operations that enable pharmaceutical facilities to deploy reliable drug delivery production solutions across diverse therapeutic environments.

The segment benefits from pharmaceutical preference for proven manufacturing technology that provides immediate production scalability without requiring complex facility modifications. Cost-effective production features enable deployment in pharmaceutical environments, biotechnology facilities, and vaccine manufacturing applications where reliability and quality consistency represent critical operational requirements.

Manufacturing services differentiate through rapid scale-up capability, proven production performance, and integration with standard pharmaceutical quality systems that enhance facility productivity while maintaining cost-effective operational profiles suitable for diverse therapeutic applications.

Key market characteristics:

- Advanced CDMO systems with multi-stage LNP processing and automatic quality control indicators

- Scalable production capacity enabling batch sizes from clinical to commercial scale with consistent quality

- Manufacturing support, including formulation development, analytical testing, and regulatory compliance support for pharmaceutical operations

By End User, the Pharmaceutical Companies Segment Accounts for the Largest Market Share

Pharmaceutical company applications dominate the LNP CDMO market due to widespread adoption of outsourced manufacturing systems and increasing focus on advanced drug delivery development, regulatory compliance, and therapeutic innovation applications that enhance product pipelines while maintaining operational efficiency.

Pharmaceutical customers prioritize service reliability, quality consistency, and integration with existing development infrastructure that enables coordinated deployment across multiple therapeutic programs. The segment benefits from substantial R&D budgets and pipeline development programs that emphasize therapeutic advancement for drug discovery and development operations.

Pharmaceutical development programs incorporate LNP CDMO services as standard components for advanced drug delivery and therapeutic innovation applications. At the same time, biopharmaceutical industry initiatives are increasing demand for specialized manufacturing that complies with regulatory standards and minimizes development timelines.

Application dynamics include:

- Strong growth in pharmaceutical and biotechnology companies requiring specialized LNP manufacturing solutions

- Increasing adoption in vaccine development and gene therapy applications for therapeutic advancement

- Rising integration with pharmaceutical development systems for project management and regulatory tracking

What are the Drivers, Restraints, and Key Trends of the LNP CDMO Market?

Pharmaceutical modernization drives primary adoption as LNP CDMO systems provide advanced drug delivery capabilities that enable therapeutic innovation without compromising safety profiles, supporting regulatory compliance and operational efficiency that require precise manufacturing management.

Biotechnology infrastructure demand accelerates market expansion as pharmaceutical operators seek effective production solutions that minimize development risks while maintaining therapeutic standards during complex formulation scenarios and regulatory operations. Therapeutic innovation spending increases worldwide, creating sustained demand for specialized manufacturing systems that complement traditional pharmaceutical processes and provide operational flexibility in complex biotechnology environments.

Manufacturing complexity challenges vary across facility types regarding formulation integration and quality control requirements, which may limit deployment flexibility and market penetration in facilities with restrictive production modifications.

Technical performance limitations persist regarding scalability and production consistency that may increase operational costs in high-volume applications with demanding quality standards and frequent batch changes. Market fragmentation across multiple regulatory standards and therapeutic protocols creates compatibility concerns between different service providers and existing pharmaceutical infrastructure.

Adoption accelerates in pharmaceutical and biotechnology sectors where advanced drug delivery manufacturing justifies service costs, with geographic concentration in developed markets transitioning toward mainstream adoption in emerging economies driven by pharmaceutical modernization and therapeutic infrastructure development.

Technology development focuses on enhanced formulation capabilities, improved quality control systems, and integration with pharmaceutical development platforms that optimize production scheduling and therapeutic quality monitoring. The market could face disruption if alternative drug delivery technologies or regulatory restrictions significantly limit LNP CDMO deployment in pharmaceutical or biotechnology applications.

Analysis of the LNP CDMO Market by Key Country

The LNP CDMO market demonstrates varied regional dynamics with Growth Leaders including United States (14.8% CAGR) and Germany (14.2% CAGR) driving expansion through pharmaceutical modernization and biotechnology infrastructure development. Steady Performers encompass U.K. (13.8% CAGR), Japan (13.4% CAGR), and France (13.0% CAGR), benefiting from established pharmaceutical sectors and advanced manufacturing adoption. Moderate Growth Markets feature South Korea (12.6% CAGR), where specialized biotechnology applications and regulatory compliance integration support consistent growth patterns.

| Country | CAGR (2025-2035) |

|---|---|

| United States | 14.8% |

| Germany | 14.2% |

| U.K. | 13.8% |

| Japan | 13.4% |

| France | 13.0% |

| South Korea | 12.6% |

Regional synthesis reveals North American and European markets leading growth through pharmaceutical modernization and biotechnology infrastructure development, while Asia-Pacific countries maintain steady expansion supported by therapeutic innovation advancement and manufacturing modernization requirements. Developed markets show strong growth driven by pharmaceutical facility applications and advanced drug delivery trends.

United States Drives Global Market Leadership

United States establishes market leadership through aggressive pharmaceutical development programs and comprehensive biotechnology infrastructure advancement, integrating advanced LNP CDMO systems as standard components in drug discovery and therapeutic development applications. The country’s 14.8% CAGR through 2035 reflects government initiatives promoting pharmaceutical manufacturing and domestic biotechnology capabilities that mandate the use of advanced production systems in pharmaceutical and research installations. Growth concentrates in major biotechnology hubs, including Boston, San Francisco, and San Diego, where pharmaceutical modernization showcases integrated CDMO systems that appeal to domestic operators seeking advanced therapeutic solutions and regulatory compliance applications.

American pharmaceutical companies are developing cost-effective LNP CDMO solutions that combine domestic production advantages with advanced features, including specialized formulation systems and enhanced quality control capacity.

Strategic Market Indicators:

- Pharmaceutical facilities leading adoption with 80% deployment rate in drug development and biotechnology facilities

- Government biotechnology programs providing substantial funding for domestic pharmaceutical manufacturing technology development

- CDMO providers capturing 70% market share through specialized services and regulatory expertise

- Biotechnology segment growth driven by pharmaceutical companies and research facility requirements for advanced manufacturing systems

- Therapeutic innovation development for specialized LNP CDMO solutions targeting global pharmaceutical markets

Germany Emerges as High-Growth Market

In major pharmaceutical centers, including Frankfurt, Munich, and Berlin, pharmaceutical and biotechnology facilities are implementing advanced LNP CDMO systems as standard services for drug development operations and regulatory compliance applications, driven by increasing pharmaceutical spending and modernization programs that emphasize biotechnology manufacturing infrastructure capabilities.

The market is projected to demonstrate a 14.2% CAGR through 2035, supported by government pharmaceutical initiatives and biotechnology infrastructure development programs that promote advanced manufacturing services for pharmaceutical and research facilities. German pharmaceutical operators are adopting LNP CDMO services that provide reliable therapeutic development management and regulatory compliance features, particularly appealing in biotechnology developments where quality standards represent critical operational requirements.

Market expansion benefits from growing pharmaceutical manufacturing capabilities and international collaboration agreements that enable development of advanced production systems for pharmaceutical and biotechnology applications.

Market Intelligence Brief:

- Pharmaceutical and biotechnology segments are driving initial adoption with 55% annual growth in service utilization

- Manufacturing modernization programs emphasizing specialized CDMO services for therapeutic development

- CDMO providers partnering with pharmaceutical companies for service development

- Research institutions and pharmaceutical facilities implementing LNP CDMO services for drug development and regulatory compliance

U.K. Shows Strong Regional Leadership

U.K.’s market expansion benefits from diverse pharmaceutical demand, including biotechnology modernization in London and Cambridge, pharmaceutical service upgrades, and government healthcare programs that increasingly incorporate advanced manufacturing solutions for therapeutic applications. The country maintains a 13.8% CAGR through 2035, driven by rising therapeutic awareness and increasing recognition of LNP CDMO technology benefits, including reliable drug delivery and improved pharmaceutical capabilities.

Market dynamics focus on specialized LNP CDMO solutions that balance advanced formulation features with regulatory considerations important to British pharmaceutical operators. Growing biotechnology development creates sustained demand for modern manufacturing services in new pharmaceutical infrastructure and therapeutic development modernization projects.

Strategic Market Considerations:

- Pharmaceutical and biotechnology segments leading growth with focus on therapeutic development and regulatory compliance applications

- Regional pharmaceutical requirements driving a diverse service portfolio from basic manufacturing to advanced formulation development systems

- Service provider expansion supported by government pharmaceutical initiatives and international partnerships

- Government biotechnology initiatives beginning to influence procurement standards and operational requirements

Europe Market Split by Country

The LNP CDMO market in Europe demonstrates strong growth potential. Germany is expected to maintain its leadership position with a 30.2% market share by 2035, supported by its advanced pharmaceutical infrastructure and major biotechnology centers, including Munich and Frankfurt. U.K. follows with a 20.8% share by 2035, driven by comprehensive pharmaceutical modernization programs and biotechnology development initiatives. France holds an 18.1% share by 2035, expected to maintain steady growth through specialized pharmaceutical applications and regulatory compliance requirements.

Italy commands a 10.5% share, while Spain accounts for 9.0% by 2035. The Nordic Countries region is anticipated to gain momentum, expanding its collective share to 9.6% by 2035, attributed to increasing LNP CDMO adoption in pharmaceutical countries and emerging biotechnology facilities implementing therapeutic development programs. BENELUX maintains 1.4% while Rest of Western Europe accounts for 0.4% by 2035.

mRNA Vaccines Dominate LNP CDMO Demand in Japan

The Japanese LNP CDMO market demonstrates a mature and innovation-focused landscape, characterized by sophisticated integration of mRNA vaccine manufacturing services with existing pharmaceutical infrastructure across biotechnology facilities, pharmaceutical companies, and research institutions. Japan’s emphasis on therapeutic excellence and quality standards drives demand for advanced LNP formulation solutions that support continuous improvement initiatives and regulatory compliance requirements in pharmaceutical operations.

The market benefits from strong partnerships between international CDMO providers like Catalent, Lonza, and domestic biotechnology leaders, including Takeda, Daiichi Sankyo, and Mitsubishi Tanabe, creating comprehensive service ecosystems that prioritize manufacturing reliability and technical expertise programs.

Pharmaceutical centers in Tokyo, Osaka, Yokohama, and other major metropolitan areas showcase advanced manufacturing implementations where LNP CDMO systems achieve high therapeutic effectiveness through integrated quality management programs.

CDMO Companies Lead Specialized Manufacturing Services in South Korea

The South Korean LNP CDMO market is characterized by strong specialized manufacturing provider presence, with companies maintaining dominant positions through comprehensive production integration and technical services capabilities for pharmaceutical facilities and biotechnology infrastructure applications.

The market is demonstrating a growing emphasis on localized manufacturing support and rapid development capabilities, as Korean pharmaceutical companies increasingly demand customized solutions that integrate with domestic biotechnology infrastructure and advanced quality control technologies deployed across the Seoul Metropolitan Area and other major pharmaceutical cities.

Local biotechnology companies and regional service providers are gaining market share through strategic partnerships with global CDMO providers, offering specialized services including formulation development programs and regulatory compliance services for pharmaceutical specialists.

The competitive landscape shows increasing collaboration between multinational pharmaceutical companies and Korean biotechnology specialists, creating hybrid service models that combine international manufacturing expertise with local market knowledge and regulatory relationship management.

Competitive Landscape of the LNP CDMO Market

The LNP CDMO market operates with moderate concentration, featuring approximately 15-20 meaningful participants, where leading companies control roughly 40-45% of the global market share through established pharmaceutical relationships and comprehensive biotechnology service portfolios. Competition emphasizes advanced formulation capabilities, service reliability, and regulatory compliance rather than price-based rivalry.

Market leaders encompass Catalent Inc., which maintains competitive advantages through extensive pharmaceutical manufacturing expertise, global CDMO service networks, and comprehensive formulation development capabilities that create customer switching costs and support premium pricing. The company leverages decades of pharmaceutical experience and ongoing research investments to develop advanced LNP CDMO services with enhanced formulation and regulatory management features.

Technology challengers include Lonza Group, Thermo Fisher Scientific, and Evonik Industries, which compete through specialized biotechnology focus and innovative manufacturing interfaces that appeal to pharmaceutical customers seeking advanced formulation capabilities and operational flexibility. These companies differentiate through rapid service development cycles and specialized therapeutic application focus.

Market dynamics favor participants that combine reliable manufacturing infrastructure with advanced formulation expertise, including therapeutic development support and automatic compliance management capabilities. Competitive pressure intensifies as traditional pharmaceutical manufacturers expand into specialized CDMO services. At the same time, biotechnology companies challenge established players through innovative formulation solutions and cost-effective platforms targeting specialized pharmaceutical segments.

Key Players in the LNP CDMO Market

- Catalent Inc.

- Lonza Group

- Thermo Fisher Scientific

- Evonik Industries

- Precision NanoSystems

- Acuitas Therapeutics

- Genevant Sciences

- BioNTech Manufacturing

- Arcturus Therapeutics

- Translate Bio

- Polymun Scientific

- Encapsula NanoSciences

- Creative Biolabs

- Avanti Polar Lipids

- Merck KGaA

- Pfizer CentreOne

- Recipharm AB

- Samsung Biologics

- WuXi Biologics

- AGC Biologics

Scope of the Report

| Item | Value |

|---|---|

| Quantitative Units | USD 485.0 Million |

| Service Type | Manufacturing Services, Development Services, Analytical Services |

| Application | mRNA Vaccines, Gene Therapy, siRNA Therapeutics, Others |

| End User | Pharmaceutical Companies, Biotechnology Companies, Research Institutes |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, U.K., Japan, France, South Korea, and 25+ additional countries |

| Key Companies Profiled | Catalent Inc., Lonza Group, Thermo Fisher Scientific, Evonik Industries, Precision NanoSystems, Acuitas Therapeutics |

| Additional Attributes | Dollar sales by service type and application categories, regional adoption trends across North America, Europe, and Asia-Pacific, competitive landscape with pharmaceutical manufacturers and biotechnology service providers, facility preferences for manufacturing quality and service reliability, integration with pharmaceutical development platforms and regulatory systems, innovations in LNP formulation technology and production efficiency, and development of specialized manufacturing solutions with enhanced therapeutic capabilities and quality monitoring features. |

LNP CDMO Market by Segments

-

Service Type :

- Manufacturing Services

- Development Services

- Analytical Services

-

Application :

- mRNA Vaccines

- Gene Therapy

- siRNA Therapeutics

- Others

-

End User :

- Pharmaceutical Companies

- Biotechnology Companies

- Research Institutes

-

Region :

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Nordic

- BENELUX

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- ASEAN

- Australia & New Zealand

- Rest of Asia Pacific

- Latin America

- Brazil

- Chile

- Rest of Latin America

- Middle East & Africa

- Kingdom of Saudi Arabia

- Other GCC Countries

- Turkey

- South Africa

- Other African Union

- Rest of Middle East & Africa

- North America

link