Is GAM’s Board Appointment Signaling a Shift in Governance or Investment Strategy?

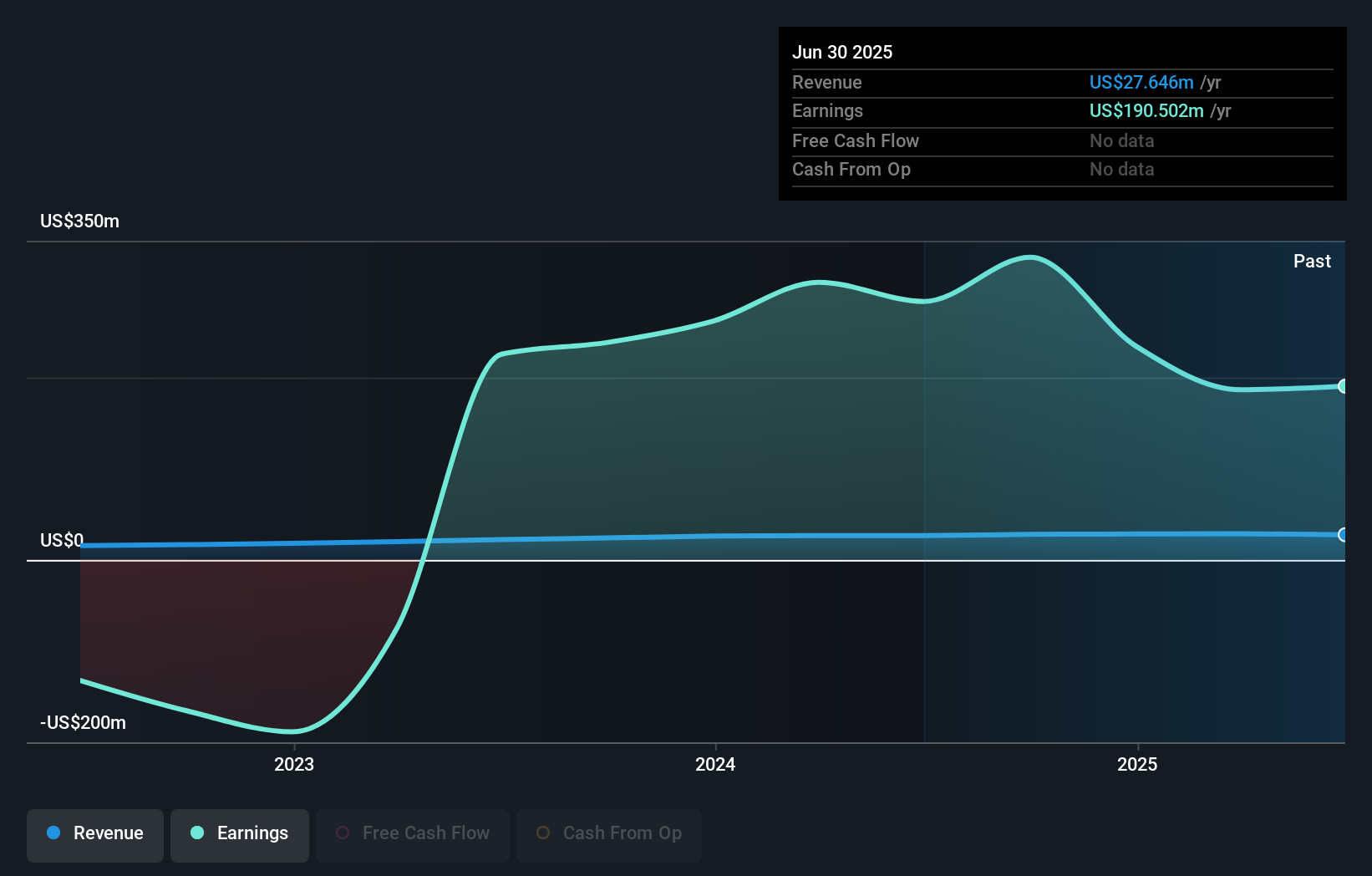

- General American Investors Company, Inc. recently announced its half-year earnings for the period ended June 30, 2025, reporting US$12.56 million in revenue and net income of US$150.38 million.

- In addition, the company’s Board has welcomed Sarah M. Ward, an experienced attorney and financial industry leader, highlighting a focus on board expertise and governance.

- We’ll examine how Sarah M. Ward’s appointment to the board may influence General American Investors Company’s investment narrative going forward.

AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part – they are all under $10b in market cap – there’s still time to get in early.

What Is General American Investors Company’s Investment Narrative?

When considering General American Investors Company, the biggest picture factor is believing in the company’s ability to deliver value through experienced management, disciplined capital allocation, and long-term investment performance. The latest earnings report highlights another period of significant net income, though driven in part by a large one-off gain, which raises questions about the sustainability of recent profit levels as a core catalyst going forward. The appointment of Sarah M. Ward brings fresh board expertise, which may positively influence governance and oversight, yet is unlikely to materially alter immediate business risks or near-term catalysts such as dividend sustainability, low revenue growth, or industry underperformance. With limited changes to fundamental risks coming from these news events, attention remains squarely on the persistence of underlying earnings and margin quality rather than headline numbers or board transitions.

But on the risk front, unstable dividend history remains front of mind for investors.

General American Investors Company’s shares have been on the rise but are still potentially undervalued by 45%. Find out what it’s worth.

Exploring Other Perspectives

Only one Community member currently estimates fair value for General American Investors Company, placing it at US$107.70. With such a narrow range, opinions from the Simply Wall St Community could shift significantly as more participants weigh in, especially given current questions around profit sustainability and how one-off items influence results. Consider exploring further viewpoints to see just how varied these investor opinions can be.

Explore another fair value estimate on General American Investors Company – why the stock might be worth just $107.70!

Build Your Own General American Investors Company Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Ready To Venture Into Other Investment Styles?

Opportunities like this don’t last. These are today’s most promising picks. Check them out now:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Try a Demo Portfolio for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

link