U.S. Contactless Payment Systems Market Size, and Growth Report, 2032

Key Highlights

| Study Period | 2019 – 2032 |

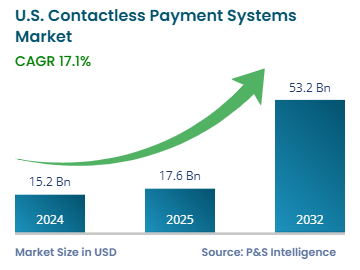

| Market Size in 2024 | USD 15.2 Billion |

| Market Size in 2025 | USD 17.6 Billion |

| Market Size by 2032 | USD 53.2 Billion |

| Projected CAGR | 17.1% |

| Largest Region | West |

| Fastest Growing Region | South |

| Market Structure | Fragmented |

Market Size

Major Companies

Important Takeaways

|

Explore the market potential with our data-driven report

U.S. Contactless Payment Systems Market Outlook

The size of the U.S. contactless payment systems Market in 2024 was USD 15.2 billion, and it will reach USD 53.2 billion by 2032 at a CAGR of 17.1% during 2025–2032. The market is driven by technological advancements, rising consumer demand for seamless transactions, and increasing smartphone, wearable usage. Contactless payments can be made by tapping credit/debit cards at a point-of-sale terminal, using mobile wallets, such as Apple Pay and Google Pay; and scanning smartwatches containing the bank payment application.

The shifting consumer preferences toward instant checkouts and paying electronically drive the market. The COVID-19 pandemic quickened the adoption of contactless payment technologies by driving the need for safer, touch-free interactions. As per Mastercard, the volume of contactless payments in the U.S. jumped by 150% in 2020 from the previous year. Contactless payments have now become standard since retail businesses, restaurants, and public transport operators have added tap-to-pay functions to their operations.

U.S. Contactless Payment Systems Market Emerging Trends

Adoption of Mobile Wallets Is Biggest Trend in market

- The usage of mobile wallets is growing rapidly among American consumers.

- As per studies, over 65% of the people in the country use mobile wallets at least once month, while over 50% use them more than conventional payment methods.

- Moreover, in 2023, 33% of the Americans had linked their digital wallets to at least two credit/debit cards, while 43% had them linked to two bank accounts at least.

- In 2024, Apple expanded its tap-to-pay service to all merchants in the U.S., eliminating the need for external terminals and allowing businesses to accept contactless payments directly on iPhones.

- Digital wallets are gaining popularity because they offer consumers fast and convenient transactions.

- As per studies, over 70% of the people in the country are open to using digital wallets as their primary payment method.

Expansion of Contactless Infrastructure Drives Market

- The fast-growing infrastructure for contactless payments is the main driver for the market expansion.

- The Federal Reserve supports contactless infrastructure through its FedNow Service, launched in July 2023, which provides 24/7 instant payment capabilities to banks and fintech companies.

- Studies suggest that over 70% of the retailers across the country in 2023 allowed people to pay without any physical contact.

- Due to such favorable conditions, 25% of all the transactions done by credit/debit cards in the U.S. in 2023 were contactless.

- The most-popular gateways for contactless payments in the country currently are Authorize.net, PayPal, BlueSnap, Stripe, Square, and Adyen.

- The California Air Resources Board said in a recent article that 69% of the debit cards in the U.S. supported contactless payments in 2023.

- All the three biggest credit/debit card merchants—Mastercard, Visa, and American Express—support this technology in the U.S.

- The CARB also says that all credit/debit cards in the country will support this payment method by 2027.

U.S. Contactless Payment Systems Market Segmentation Analysis

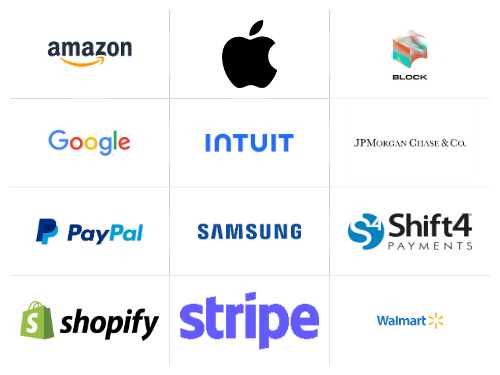

Insights by type

Mobile wallets lead the U.S. contactless payment systems market with a share of 55%. This is due to increase in the use of digital wallets because they provide people with fast payments and convenient experiences. The inclusion of payment capabilities in smartphones has made these devices suitable for all types of daily commercial activities. The consumer demand for contactless payment methods increased during the COVID-19 pandemic because they needed hygienic touch-free solutions. People also use mobile payment platforms to access loyalty programs and personalized offers.

The types analyzed here are:

- Mobile Wallets (Largest Category)

- Card-Based (Fastest-Growing Category)

- Others

Insights by Application

The retail category dominates the market with a share of 50% because this sector now provides customers with quick and safe transaction systems. Contactless payment systems eliminating waiting times at the counter, thus creating efficient business processes. The COVID-19 pandemic started this shift by making both retailers and customers compelled to use the hygienic contactless payment systems. Most retailers in the country have NFC-enabled terminals, which enable tap-and-go transactions efficiently. According to the CARB, 85% of the grocery payments in the U.S. were contactless in 2023.

The hospitality category will witness the highest CAGR as people are increasingly paying for hotels and meals via mobile wallets and contactless credit/debit cards. With this technology, diners do not need to move to the counter and stand in line to pay. The POS is brought to them for them to pay without moving. Moreover, people staying at a hotel can instantly pay for room service via this method. Similarly, most people pay for food delivery online, either via third-party mobile wallets or the mobile app of their bank.

The applications analyzed here are:

- Retail (Largest Category)

- Consumer electronics

- Fashion & garments

- Others

- Transportation

- Healthcare

- Hospitality (Fastest-Growing Category)

- Others

Insights by technology

Near-field communication leads the market with a share of 60% because this technology enables fast and secure device-to-device transactions at close distances. NFC implementation into smartphone and payment terminals allows customers to achieve contactless tap-and-go, enhancing speed and convenience. NFC is also popular because of its strong security features, which include encryption and tokenization to protect customer data.

The technologies analyzed here are:

- Near-Field Communication (NFC) (Largest Category)

- Radiofrequency Identification (RFID)

- Bluetooth Low Energy (BLE) (Fastest-Growing Category)

- Host Card Emulation (HCE)

- Magnetic Secure Transmission (MST)

Drive strategic growth with comprehensive market analysis

U.S. Contactless Payment Systems Market Regional Growth Dynamics

The Western region dominates the market with 40% revenue because customers here have high technical aptitude and big technology centers exist in the area. San Francisco and Seattle have numerous companies developing contactless payment technologies, and residents here have quickly accepted digital wallets and tap-to-pay methods. Contactless-enabled cards and mobile payment systems have expanded considerably within this region since the COVID-19 pandemic.

The regions analyzed here are:

- Northeast

- Midwest

- West (Largest Region)

- South (Fastest-Growing Region)

U.S. Contactless Payment Systems Market Share

The market is fragmented with both dominant and various smaller players. This is because to enable contactless payments, an array of PoS terminals, credit/debit cards, and software is required. While some companies manufacture PoS terminals, some specialize in software, such as payment gateways for banks, merchants, and third-party mobile wallets.

Even hardware manufacturers are diverse, based on the end use. For instance, companies that make PoS terminals for retail stores do not generally make AFC gates or self-service ticketing kiosks for metro stations. Additionally, credit/debit cards are generally offered by Mastercard, American Express, and Visa, but these devices require the appropriate hardware and software to enable the transactions.

Key U.S. Contactless Payment Systems Companies:

- Apple Inc.

- Google LLC

- PayPal Holdings, Inc.

- Block, Inc.

- Samsung Electronics Co., Ltd.

- Stripe, Inc.

- JPMorgan Chase & Co.

- Intuit Inc.

- Shopify Inc.

- Walmart Inc.

- Amazon.com, Inc.

- Shift4 Payments, Inc.

U.S. Contactless Payment Systems Market News

- In March 2025, Walmart Inc. introduced Klarna as its new buy-now-pay-later (BNPL) provider for the U.S. Through this partnership, Walmart enables customers to obtain flexible installment loans across online and store-based purchases.

- In July 2024 Stripe purchased Lemon to boost its payment processing operations.

link

![[Latest] Global Left Ventricular Assist Devices Market Size/Share [Latest] Global Left Ventricular Assist Devices Market Size/Share](https://ml.globenewswire.com/Resource/Download/d846fc35-c099-4905-b615-f57f20857855/global-left-ventricular-assist-devices-market-2025-2034-by-billion-.png)