Assessing Lockheed Martin (LMT) Valuation After Defense Budget Proposal And Seven Year Patriot Contract

Lockheed Martin (LMT) is back in the spotlight after President Donald Trump proposed a US$1.5 trillion U.S. defense budget for fiscal 2027 and the Pentagon awarded a seven year Patriot missile production contract.

See our latest analysis for Lockheed Martin.

That backdrop helps explain why the share price is now at US$542.92, with a 1-day share price return of 4.72% and a 30-day share price return of 13.05%, while the 1-year total shareholder return of 15.68% points to momentum building rather than fading.

If Pentagon contracts and budget headlines have your attention, it could be a good moment to see what else is moving across aerospace and defense stocks.

Lockheed Martin now trades close to record levels after a powerful run, supported by a proposed US$1.5t defense budget and a multi year missile contract. The key question for investors is whether there is still value on the table or whether the market is already pricing in future growth.

Most Popular Narrative: 2.8% Overvalued

Compared to Lockheed Martin’s last close at US$542.92, the most followed narrative fair value of about US$528 points to a modest premium and a finely balanced valuation debate.

The growing focus on homeland defense initiatives such as “Golden Dome,” missile warning networks, and increased munitions spending suggests future secular increases in U.S. defense budgets and multi-year, high-value contract awards that are likely to contribute meaningfully to backlog, revenue visibility, and cash flow stability.

Lockheed Martin continues to invest heavily in R&D and next-generation technologies, enabling it to maintain technological leadership and diversify future revenue streams, further supported by public-private partnerships (e.g., rare earth magnet supply chain). All of these factors are expected to support sustainable earnings and cash flow growth over the long term.

Read the complete narrative.

Curious how a mid single digit revenue profile, higher margin outlook and a richer future P/E all come together to justify that fair value? The full narrative lays out the exact earnings bridge, the implied multiple reset and the cash flow path that support this US$528 figure.

Result: Fair Value of $528.17 (OVERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, there are still pressure points to watch, including further cost overruns on complex fixed price programs and potential cash flow hits from the US$4.6b IRS tax dispute.

Find out about the key risks to this Lockheed Martin narrative.

Another View: Earnings Based Valuation Paints A Different Picture

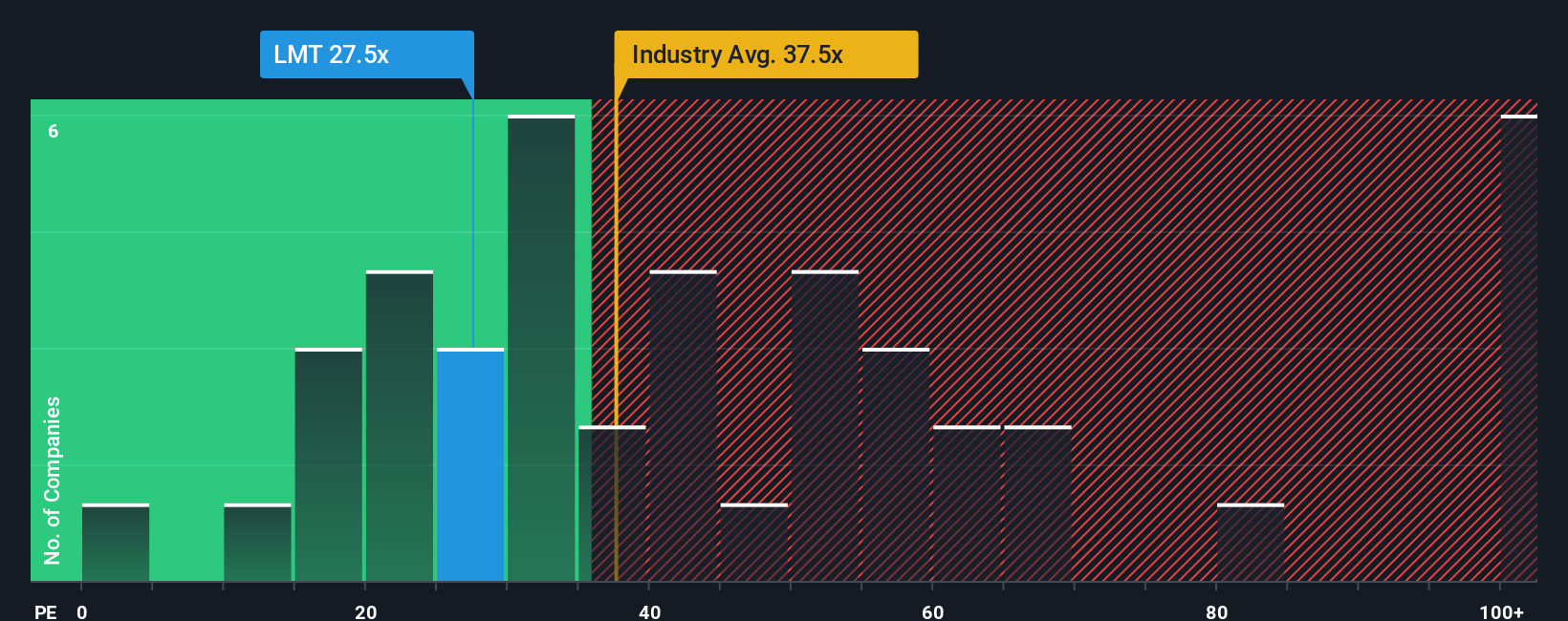

While the most popular narrative sees Lockheed Martin as about 2.8% overvalued, the earnings based view tells a different story. At a P/E of 29.9x, the shares sit below the industry at 40.3x, peers at 36.8x, and the fair ratio of 35.2x. This hints at a valuation gap that could either close or widen from here.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lockheed Martin Narrative

If you see the numbers differently or prefer to work through the data yourself, you can build a fresh view in just a few minutes: Do it your way.

A great starting point for your Lockheed Martin research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Ready For More Investment Ideas?

If you stop with just one company, you could miss other opportunities that fit your style, so take a few minutes to scan these focused stock groups.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Explore Now for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

link

:max_bytes(150000):strip_icc()/GettyImages-104533302-2ae5e6cab07f4250805da4bb7b6056d0.jpg)