Ultra-Clean Yogurt Filling System Market | Global Industry Analysis & Outlook

Ultra-Clean Yogurt Filling System Market Forecast and Outlook 2026 to 2036

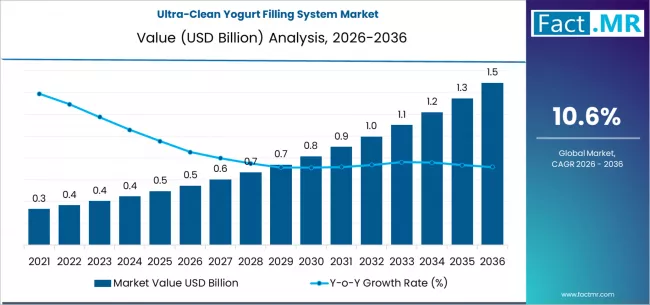

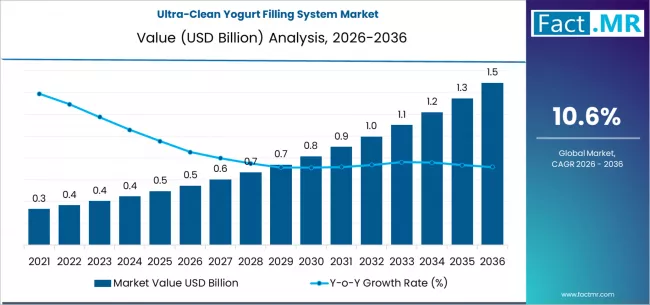

The global ultra-clean yogurt filling system market is projected to total USD 0.55 billion in 2026, and is projected to reach USD 1.49 billion by 2036, progressing at a 10.6% CAGR. This robust growth is driven by the dairy industry’s dual imperative: extending shelf life without preservatives and meeting escalating consumer demand for clean-label, refrigerated products.

Key Takeaways from the Ultra-Clean Yogurt Filling System Market

- Market Value for 2026: USD 0.55 Billion

- Market Value for 2036: USD 1.49 Billion

- Forecast CAGR 2026 to 2036: 10.6%

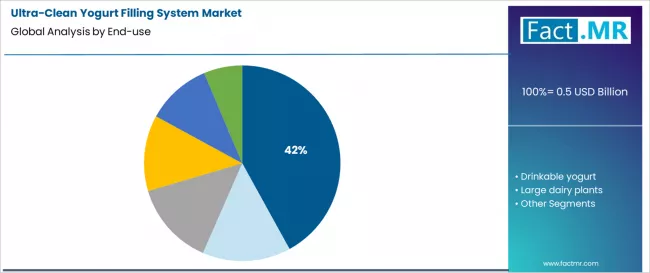

- Leading End-Use Segment (2026): Yogurt & Fermented Dairy (42.0%)

- Leading Filling System Type (2026): Ultra-Clean Cup & Bottle Fillers (47.3%)

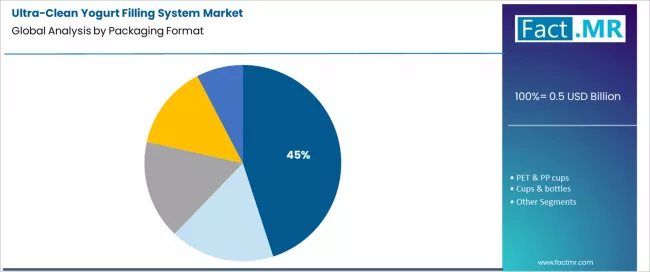

- Leading Packaging Format (2026): Cups, Bottles, Pouches (45.0%)

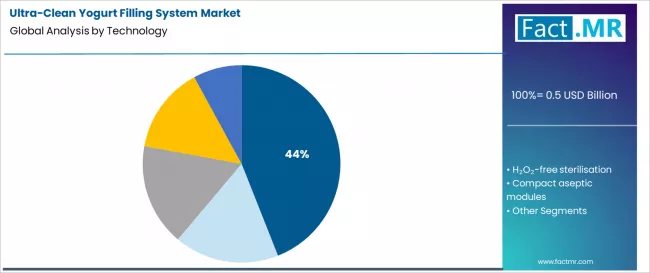

- Leading Technology Segment (2026): HEPA-Filtered Filling + Sterile Air (44.0%)

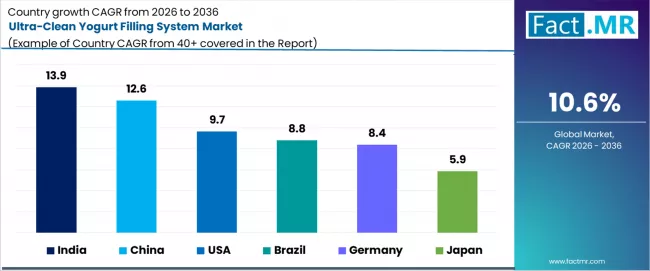

- Key Growth Countries: India (13.9% CAGR), China (12.6% CAGR), USA (9.7% CAGR), Brazil (8.8% CAGR), Germany (8.4% CAGR), Japan (5.9% CAGR)

- Key Players: Tetra Pak, GEA Group, Newamstar, Nichrome India Ltd., KHS GmbH, Shibuya Corporation

Ultra-clean filling technology creates a locally sterile environment around the filling point, significantly reducing post-pasteurization contamination and enabling extended fresh distribution. This approach represents a critical operational upgrade, bridging the gap between traditional hygienic filling and full aseptic processing.

It allows manufacturers to achieve 60-90 day shelf-life for sensitive probiotic yogurt without the complexity and cost of sterilizing the packaging material itself. Reduced spoilage, expanded geographic market reach, and a stronger no artificial preservatives claim are rendering ultra-clean yogurt filling systems a strategic investment for brands competing in the premium and functional dairy segments.

Ultra-Clean Yogurt Filling System Market

| Metric | Value |

|---|---|

| Market Value (2026) | USD 0.55 Billion |

| Market Forecast Value (2036) | USD 1.49 Billion |

| Forecast CAGR 2026 to 2036 | 10.6% |

Category

| Category | Segments |

|---|---|

| End-Use | Yogurt & Fermented Dairy, Drinkable Yogurt, Large Dairy Plants, Value Dairy Brands, Yogurt Exports, Premium Dairy |

| Filling System Type | Ultra-Clean Cup & Bottle Fillers, Rotary Ultra-Clean Fillers, High-Speed Fillers, Inline Fillers, Others |

| Packaging Format | Cups, Bottles, Pouches, PET & PP Cups, Cups & Bottles, Cups & Pouches, Others |

| Technology | HEPA-Filtered Filling + Sterile Air, H₂O₂-Free Sterilisation, Compact Aseptic Modules, Cost-Efficient Ultra-Clean Tech, Others |

| Region | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

How does Advanced Process Control Bridge the Gap between Hygienic and Fully Aseptic Operation?

The industrial automation core of this market lies in maintaining a precisely controlled, ISO 5 (Class 100) clean zone over the open package during filling. This is not merely about HEPA filters but involves complex automated control of laminar sterile airflows, positive pressure differentials, and real-time monitoring of critical parameters like airborne particle counts.

Advanced systems use sensor networks and programmable logic controllers to automatically adjust airflows and trigger alarms if conditions deviate, ensuring the sterile barrier is never compromised. This level of automated environmental control is what differentiates ultra-clean technology from simple clean-room filling, enabling reliable shelf-life extension without the chemical sterilization of packages.

Segmental Analysis

By Technology, Which Approach is dominating as the Standard for Shelf-Life Extension?

HEPA-filtered filling combined with sterile air overpressure commands a leading 44.0% share. This technology establishes a localized, ultra-clean zone by flooding the filling chamber with sterile, filtered air, preventing ambient contaminants from settling into the product or open container. Its dominance is due to its effectiveness and relative operational simplicity compared to full aseptic systems.

It delivers the critical shelf-life extension required for premium yogurt, often doubling it from 30 to 60 days, without requiring chemical sterilants like hydrogen peroxide, aligning with clean-label trends and reducing operational complexity for dairy plants.

By End-Use, Which Category is the Primary Utilizer of Ultra-Clean Yogurt Filling Systems?

Yogurt and fermented dairy constitute the primary end-use segment at 42.0%. This segment, especially products containing live and active probiotic cultures, is uniquely sensitive to post-processing contamination which can spoil the product and degrade its health claim.

Ultra-clean filling directly protects these valuable cultures and the product’s sensory characteristics. The high volume and competitive nature of the yogurt market make the reduction in spoilage rates and the ability to access wider distribution channels a compelling return on investment, driving widespread adoption.

By Packaging Format, Which Container Type Presents the Greatest Challenge and Opportunity?

Cups, bottles, and pouches collectively hold a dominant 45.0% share. While cups are the traditional format, the growth of drinkable yogurt in bottles and pouches expands the application scope. Each format presents distinct engineering challenges for maintaining the sterile air curtain over the filling nozzle.

The technology’s ability to adapt to this variety of containers is key to its market penetration, allowing dairy processors to use the same ultra-clean principle across different product lines and packaging innovations.

What are the Principal Drivers, Constraints, and Evolving Dynamics of the Ultra-Clean Yogurt Filling System Market?

Growth is principally driven by consumer demand for extended-shelf-life, preservative-free dairy and the economic imperative for manufacturers to reduce cold chain waste and expand distribution reach. A significant constraint is the substantial capital investment and higher operational expertise required compared to standard filling lines, which can be a barrier for smaller regional dairies.

A major opportunity lies in the development of modular, plug-and-play ultra-clean modules that can be retrofitted onto existing filling lines, dramatically lowering the entry barrier. The key trend is the move toward chemical-free sterilization methods, such as intense pulsed light or dry sterilization with gaseous nitrogen dioxide, which further support clean-label production and reduce environmental impact.

Analysis of the Ultra-Clean Yogurt Filling System Market by Key Countries

| Country | CAGR 2026 to 2036 |

|---|---|

| USA | 9.7% |

| Germany | 8.4% |

| China | 12.6% |

| India | 13.9% |

| Brazil | 8.8% |

| Japan | 5.9% |

How do Private Label Innovation and National Distribution Needs Shape the Landscape in USA?

A 9.7% CAGR is supported by the strength of supermarket private-label brands and national dairy companies requiring long-distance distribution. The primary demand driver is the yogurt and premium dairy sector’s need to ensure consistency and shelf-life across a continent-wide supply chain.

Investments are focused on high-speed, rotary ultra-clean fillers integrated with cup de-nesting and lidding systems from major OEMs, emphasizing throughput and reliability to serve high-volume branded and private-label production.

What Characterizes Germany’s Focus on Premium Quality and Technical Precision?

An 8.4% CAGR reflects Germany’s leadership in high-value dairy production and stringent food quality standards. The market is driven by the premium dairy and yogurt export sector, where exceptional quality and extended shelf-life are non-negotiable for brand reputation.

Industry capacity for high-precision automation supports demand for fillers with impeccable clean-zone control and seamless integration with downstream labeling and casing equipment, often supplied by engineering leaders like GEA Group and KHS within the region.

What underpins China’s Rapid Scale-Up in Drinkable and Functional Yogurt Production?

China’s 12.6% CAGR is fueled by massive domestic consumption growth in drinkable yogurt and functional dairy products. The demand driver is the need for high-speed, high-volume filling of PET bottles and cups to meet this demand while maintaining product integrity.

Significant domestic industry capacity, with players like Newamstar, is scaling to provide cost-optimized ultra-clean and compact aseptic modules tailored for the massive, fast-moving Chinese dairy market, focusing on efficiency and scalability.

How is India’s Large-Scale Dairy Cooperative and Plant Modernization Driving Demand?

India’s leading 13.9% CAGR is propelled by the modernization of its large dairy cooperatives and private plants. The primary demand driver is the need to process vast volumes of milk into value-added yogurt with reduced spoilage for both domestic consumption and potential export.

The scale of operations favors high-speed fillers and creates demand for compact, cost-efficient ultra-clean technology that can be deployed across multiple production lines. Domestic packaging machinery providers are key ecosystem players in delivering solutions aligned with local cost and scale parameters.

Why is Brazil’s Growth Linked to Value-Added Dairy and Brand Competition?

An 8.8% CAGR is closely tied to the competitive dynamics within Brazil’s value dairy segment, including yogurt and fermented beverages. Local and multinational brands are investing to improve product quality and shelf-life to gain market share.

This drives demand for inline fillers and cost-efficient ultra-clean technology suitable for cups and pouches, allowing manufacturers to upgrade existing lines without the capital outlay for full rotary systems, balancing performance gains with investment cost.

What defines Japan’s Focus on Premiumization and Export-Quality Standards?

Japan’s 5.9% CAGR represents a sophisticated, quality-obsessed market. Demand is defined by the needs of the premium dairy and yogurt export sector, where products must withstand long logistics chains while maintaining perfect texture and probiotic viability.

The market favors ultra-clean fillers from precision engineering specialists like Shibuya, which offer exceptional accuracy, gentle product handling, and seamless integration with Japan’s highly automated, small-batch production environments for specialty and gift-oriented dairy products.

Competitive Landscape of the Ultra-Clean Yogurt Filling System Market

A mix of global dairy processing giants and specialized packaging machinery firms characterizes the competitive landscape. Integrated players like Tetra Pak and GEA Group compete by offering ultra-clean fillers as part of comprehensive processing and packaging lines, leveraging their deep understanding of dairy microbiology and process engineering. Success increasingly depends on providing validated performance guarantees for shelf-life extension and low rates of post-filling contamination.

Strategic partnerships with culture suppliers and packaging material producers are common to optimize total system performance. The competitive frontier is shifting toward digital services, offering remote monitoring of clean-zone parameters and predictive maintenance for critical HEPA and air-handling units, ensuring consistent uptime and product safety.

Key Players in the Ultra-Clean Yogurt Filling System Market

- Tetra Pak

- GEA Group AG

- Newamstar

- Nichrome India Ltd.

- KHS GmbH

- Shibuya Corporation

Scope of Report

| Items | Metrics |

|---|---|

| Quantitative Units | USD Billion |

| Technology | HEPA-Filtered Filling + Sterile Air, H₂O₂-Free Sterilisation, Compact Aseptic Modules, Cost-Efficient Ultra-Clean Tech, Others |

| Filling System Type | Ultra-Clean Cup & Bottle Fillers, Rotary Ultra-Clean Fillers, High-Speed Fillers, Inline Fillers, Others |

| End-Use | Yogurt & Fermented Dairy, Drinkable Yogurt, Large Dairy Plants, Value Dairy Brands, Yogurt Exports, Premium Dairy |

| Packaging Format | Cups, Bottles, Pouches, PET & PP Cups, Cups & Bottles, Cups & Pouches, Others |

| Key Countries | India, China, USA, Brazil, Germany, Japan |

| Key Companies | Tetra Pak, GEA Group, Newamstar, Nichrome, KHS, Shibuya |

| Additional Analysis | Microbial load reduction benchmarking across different technologies; total cost analysis factoring in spoilage reduction and market expansion; study of clean-zone validation protocols and regulatory compliance; impact on energy consumption versus full aseptic systems; analysis of retrofit potential for existing cup fillers. |

Market by Segments

-

End-Use :

- Yogurt & Fermented Dairy

- Drinkable Yogurt

- Large Dairy Plants

- Value Dairy Brands

- Yogurt Exports

- Premium Dairy

-

Filling System Type :

- Ultra-Clean Cup & Bottle Fillers

- Rotary Ultra-Clean Fillers

- High-Speed Fillers

- Inline Fillers

- Others

-

Packaging Format :

- Cups, Bottles, Pouches

- PET & PP Cups

- Cups & Bottles

- Cups & Pouches

- Others

-

Technology :

- HEPA-Filtered Filling + Sterile Air

- H₂O₂-Free Sterilisation

- Compact Aseptic Modules

- Cost-Efficient Ultra-Clean Tech

- Others

-

Region :

-

North America

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

-

Western Europe

- Germany

- France

- Italy

- Spain

- UK

- BENELUX

- Rest of Western Europe

-

Eastern Europe

- Russia

- Poland

- Czech Republic

- Rest of Eastern Europe

-

East Asia

- China

- Japan

- South Korea

- Rest of East Asia

-

South Asia & Pacific

- India

- ASEAN

- Australia

- Rest of South Asia & Pacific

-

MEA

- GCC Countries

- South Africa

- Turkiye

- Rest of MEA

-

Bibliography

- 3-A Sanitary Standards, Inc. (2025). 3-A Sanitary Standard 32-07 for Aseptic and Ultra-Clean Processing Systems.

- European Dairy Association (EDA). (2024). Guidelines on Extended Shelf-Life (ESL) Technologies for Dairy Products.

- International Dairy Federation (IDF). (2025). Bulletin 512: Hygienic Design and Operation of Dairy Filling Machines.

- Journal of Dairy Science. (2024). Efficacy of Non-Thermal Sterilization Technologies in Ultra-Clean Filling Environments.

- U.S. Food and Drug Administration (FDA). (2024). Grade “A” Pasteurized Milk Ordinance.

- World Health Organization (WHO) & FAO. (2024). Code of Hygienic Practice for Milk and Milk Products.

link

:max_bytes(150000):strip_icc()/GettyImages-104533302-2ae5e6cab07f4250805da4bb7b6056d0.jpg)